We Are Okay, but It Is Not Clear Sailing

I hope everyone is enjoying the coming of Spring, the season of new beginnings. Spring brings changes in temperature, blooming flowers and trees, and longer days, but still mother nature can throw in some nasty surprises. Our heart goes out to the unfortunate families affected by the tornadoes across the country last week.

The first quarter of 2023 the markets started off with a roar and gained back some ground from a dismal 2022, but then they fell back in February due to fears that the Federal Reserve (Fed) would raise interest rates too aggressively and then the potential contagion of several bank failures. In March the market regained its momentum from artificial stimulus provided by the Fed.

For the first quarter of 2023, the S&P 500 Index gained 7.0%, the NASDAQ Index gained 16.8%, the Russell 2000 Growth Index gained 5.9%, and the iShares Barclays 7-10 yr. Treasury Bond ETF (IEF) gained 3.5%.[1]

[1] These returns are priced based and exclusive of dividend reinvestment.

The Fed is injecting more money into the economy to support banks, and that’s helping to boost equities, but at the same time works against their efforts to get control of inflation. In addition, the Fed is making it too easy for bad banking to continue since constant bailouts exacerbate risk while consequences of poor decision making are muted. This is akin to a bunch of kids playing with knives and having mommy come to the aid with a band aid when one cuts themself but doesn’t take away the knives from the others. Most likely, the situation will not end well.

The Fed began an expansion of various emergency lending facilities in an attempt to ensure we’ll avoid a systemic liquidity crisis. A liquidity crisis is a financial situation characterized by a lack of cash or easily-convertible-to-cash assets on hand across many businesses or financial institutions simultaneously. If a liquidity crisis occurs, like in 2008, it can be devastating to the economy as businesses can’t access funds for their short-term financing.

Many companies run their business on a net payment basis. One example you may have heard is paying for something on a Net 30 Term which means payment is due in thirty days. Terms can extend to net 60 or net 90 as a courtesy to clients who always pay on time, but the business may have to access short-term lending to pay for the cost to carry the amount. If liquidity is disrupted, a domino effect may ensue as businesses might not be able to provide terms to their customers which could halt sales; they might not be able to pay their payroll, and they could lose the ability to finance raw material purchases to make more products. In short, there is a cascading negative economic effect which the Fed is deathly afraid of and why they injected reserves into the banking system despite the action being counter to their inflation fighting promise.

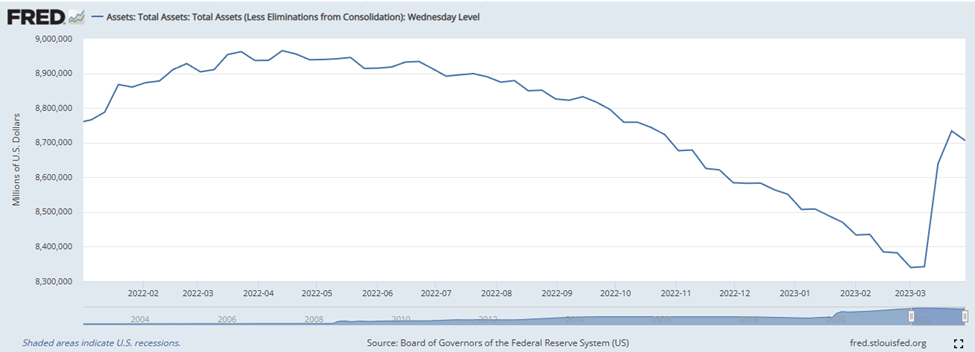

The below graph depicts the total assets held by the Fed. As the Fed buys assets from financial institutions, they are effectively pumping money into the economy. Note the sharp rise in total assets by the Fed in early March as the money was injected into the banking system. A key point here is that the Fed is not a business with earnings, so they are manufacturing money out of nothing, which is inflationary. As I wrote, in the height of the COVID period when the Fed and the government were effectively handing out money, too much money chasing too few goods caused inflation.

In addition to the Fed providing added liquidity in the U.S., on March 19th, they joined with the Bank of Canada, Bank of England, Bank of Japan, European Central Bank and Swiss National Bank in a coordinated action to enhance the provision of liquidity through the standing U.S. dollar swap line arrangements. In doing so, the monetary authorities said the move would “serve as an important liquidity backstop to ease strains in global funding markets, thereby helping to mitigate the effects of such strains on the supply of credit to households and businesses.”

The key takeaway is that recent market strength may not continue.

Here is a list of what I want to become comfortable with before becoming more aggressive:

- What development and associated risk has occurred to worry the monetary authorities?

- What is the probability of a full-scale banking crisis?

- What is the effect of the Fed’s current change in policy to fight a liquidity crisis in terms of further inflation?

- How much further assistance can the Fed provide considering the current debt to GDP ratio of 120% versus approximately 60% proceeding the 2008 financial crisis?

Again, as the Fed provides more monetary reserves, it is inflationary, and they must change course at some point to achieve their 2% target by raising interest rates. If one compares the above graph with stock market action, they should notice a positive correlation. So, if the Fed begins to aggressively reengage fighting inflation by raising rates, the stock market will be vulnerable to a correction. This probability is high and why it is not clear sailing, in my opinion.

On an absolute basis, I’m comforted that the global monetary authorities have been proactive in providing a potential backstop to stem off a systemic banking liquidity crisis. However, I’m not comforted that the banking industry once again is being bailed out on the back of taxpayers with no real lessons learned and at the cost of a reduced stance on fighting inflation.

My expectation is that we will see a weaker stock market as the Fed turns back to fighting inflation and then a stronger market as their policies take hold.

My thoughts from the beginning of the year have not changed. The economy is certainly in a state of flux, and I expect a change in stock market leadership. Much of the shine and fluff of the past market leaders is gone and they are in the process of correcting to normal levels. The exciting part of this is that change allows new opportunities to emerge as investors seek out fresh ideas. I am a bit cautious at the moment, but fully believe that many new investment ideas will be emerging, especially for smaller, nimble U.S. companies which can navigate this difficult environment.

Lastly, since many are wondering about the safety of their money, let me provide a little insight. For a comprehensive look, please refer to the FDIC website. If you have money in a bank, the standard insurance amount is $250,000 per depositor, per insured bank, for each account ownership category.

The FDIC provides separate coverage for deposits held in different account ownership categories. Depositors may qualify for coverage over $250,000 if they have funds in different ownership categories and all FDIC requirements are met. For joint accounts, it is $250,000 per co-owner. For business, it is also $250,000. So, if you have large cash balances, be aware that there are limits as to what is insured if your bank fails.

All deposits that an account holder has in the same ownership category at the same bank are added together and insured up to the standard insurance amount.

If large cash balances are held, some brokerage institutions can be considered. In my case, I hold assets in accounts with Landolt Securities, Inc which in turn contracts RBC Clearing & Custody to provide custodial services. RBC Insured Deposits availability is subject to certain restrictions. RBC Insured Deposits is designed to provide up to $5 million in FDIC coverage per depositor in each insurable ownership capacity. Each deposit account constitutes a direct obligation of the program bank and is not directly or indirectly an obligation of RBC Capital Markets, LLC.

Please note that each client’s investments are different and handled differently. Investment and insurance products offered through RBC Capital Markets, LLC are not insured by the FDIC or any other federal government agency; are not deposits or other obligations of, or guaranteed by, a bank or any bank affiliate; and are subject to investment risks, including possible loss of the principal amount invested.

Investment assets are covered against the business risk of the institution holding those assets which are covered by the Securities Investor Protection Corporation, better known as SIPC. SIPC protects against the loss of cash and securities such as stocks and bonds held by a customer at a financially troubled SIPC-member brokerage firm. The limit of SIPC protection is $500,000, which includes a $250,000 limit for cash. SIPC does not cover market losses.

In the case of Torii® Asset Management, it is an investment management firm and does not hold any assets. Torii Asset Management also cannot access funds held by RBC Clearing & Custody. Landolt Securities, Inc provides brokerage services and holds the brokerage licenses of financial professionals and firms like Torii Asset Management and does not hold assets. If you would like more information about enhanced asset protection, please feel free to contact Jeff Batterson.

This market commentary is provided by Martin Yokosawa and Jeff Batterson at Torii® Asset Management. We would like to get your advice on how to make these letters as valuable as possible. If you have any suggestions, please email us at jb@toriiassetmanagement.com. You can also learn more about Torii® Asset Management and view past letters at www.toriiassetmanagement.com.

Very truly yours,

Martin L. Yokosawa

Torii® Asset Management, Inc. Landolt Securities, Inc.

9S040 Stearman Drive, Naperville, IL. 60564

Copyright Martin L. Yokosawa. All Rights Reserved

Securities processed by and investment advice provided through Landolt Securities, Inc.

Member: FINRA/SIPC

Torii Asset Management, Inc. and Landolt Securities, Inc. are not affiliated companies.